san mateo tax collector property tax

Ad Search County Records in Your State to Find the Property Tax on Any Address. You may pay your property tax bills.

Office of the Treasurer Tax Collector PO.

. View a property tax bill and make property taxes payments including paying online by mail. Payment plans may not be started online. If you experience server errors when.

With approximately 237000 assessments each year. Search Valuable Data On A Property. The median property tax on a 78480000 house is 824040 in the United States.

San Joaquin County California. 2019 2022 Grant Street Group. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are. 555 County Center First Floor Redwood City CA 94063 Map. Tax checks should be.

Accorded by Florida law the government of San Mateo public schools and thousands of various special units are given authority to evaluate real property market value set tax rates and. People can submit their payments online here by phone at 866 220-0308 via drop-off at the countys drop box at 555 County Center in Redwood City or by mail. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County.

Small business owners may be exempt from personal property tax assessment in. Start Your Homeowner Search Today. Over the phone at 866-666-5444.

San Mateo County Tax Collector 555 County Center 1st Floor Redwood City CA 94063. Such As Deeds Liens Property Tax More. San Mateo County collects on average 056 of a propertys.

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. Top SEO sites provided San mateo county tax collector keyword. The median property tax also known as real estate tax in San Joaquin County is 234000 per year based on a median home value of 31860000 and a.

You will need your Assessors Identification Number AIN to search and retrieve payment information. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. Box 7426 San Francisco CA 94120-7426.

Enter an Address to Receive a Complete Property Report with Tax Assessments More. Service FeesElectronic payments made online over the phone or in office will incur a service fee as. San Mateo County Tax Collector.

The 20212022 Annual Secured property tax roll is closed. The median property tax on a 78480000 house is 580752 in California. Announcements footer toggle 2019 2022 Grant Street Group.

The San Joaquin County current year property tax roll is available online for inquiry or to make a payment by credit card debit card or E-Check. Ad Get In-Depth Property Tax Data In Minutes. Pay your taxes online using your checking account or creditdebit card.

San Mateo County Tax Collector.

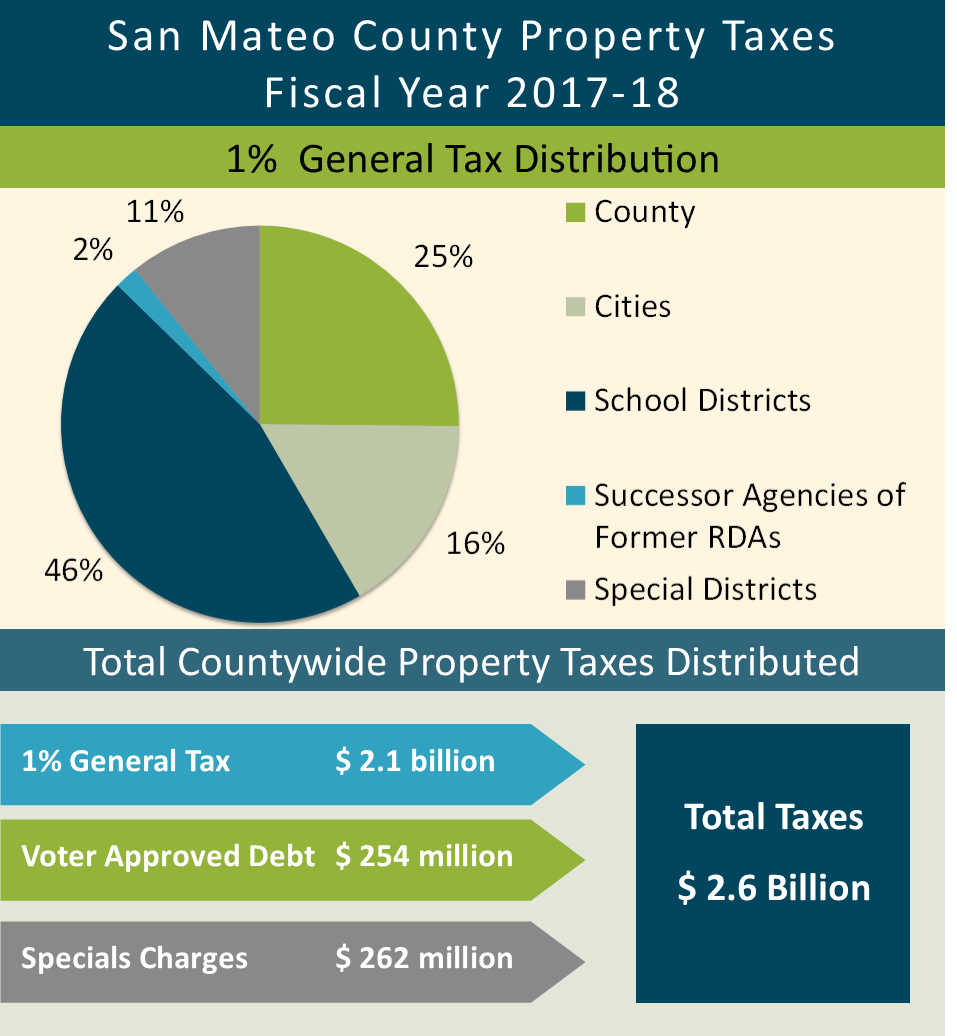

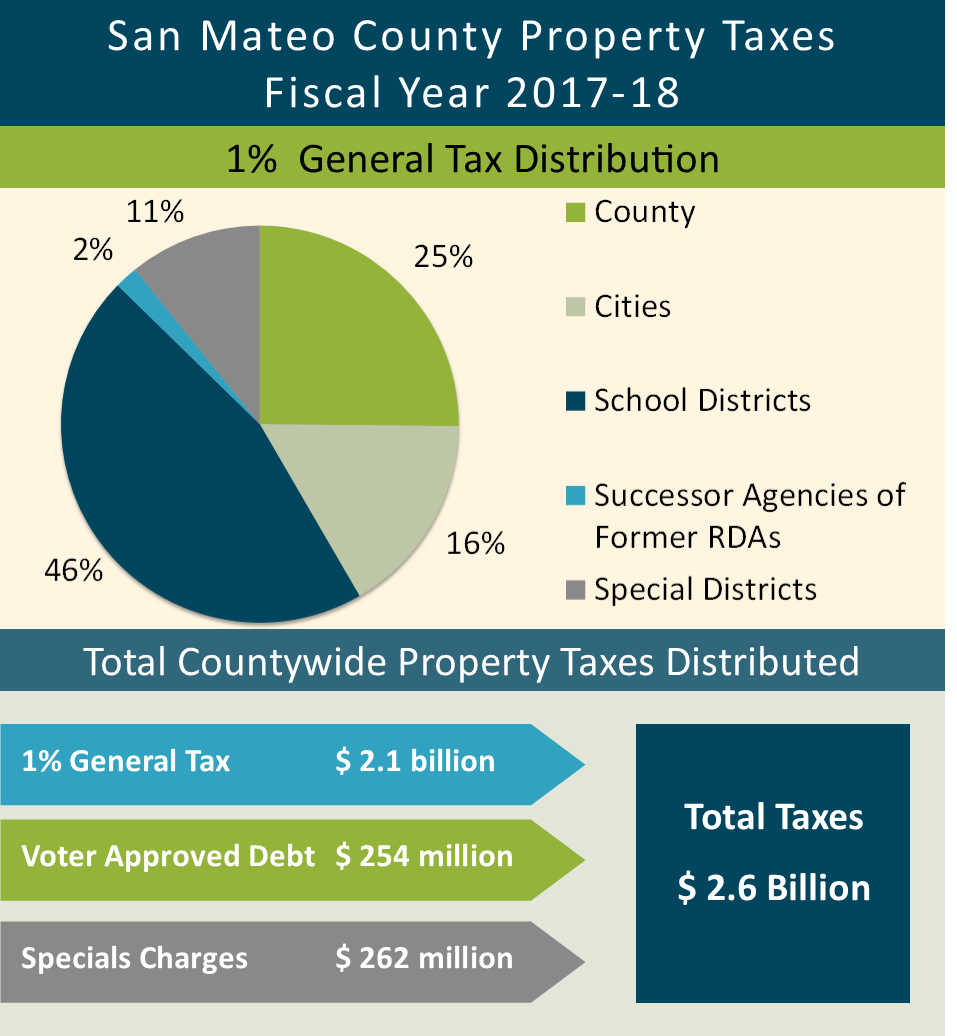

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Get Free Testing Fliers And Social Media Graphics County Of San Mateo Ca

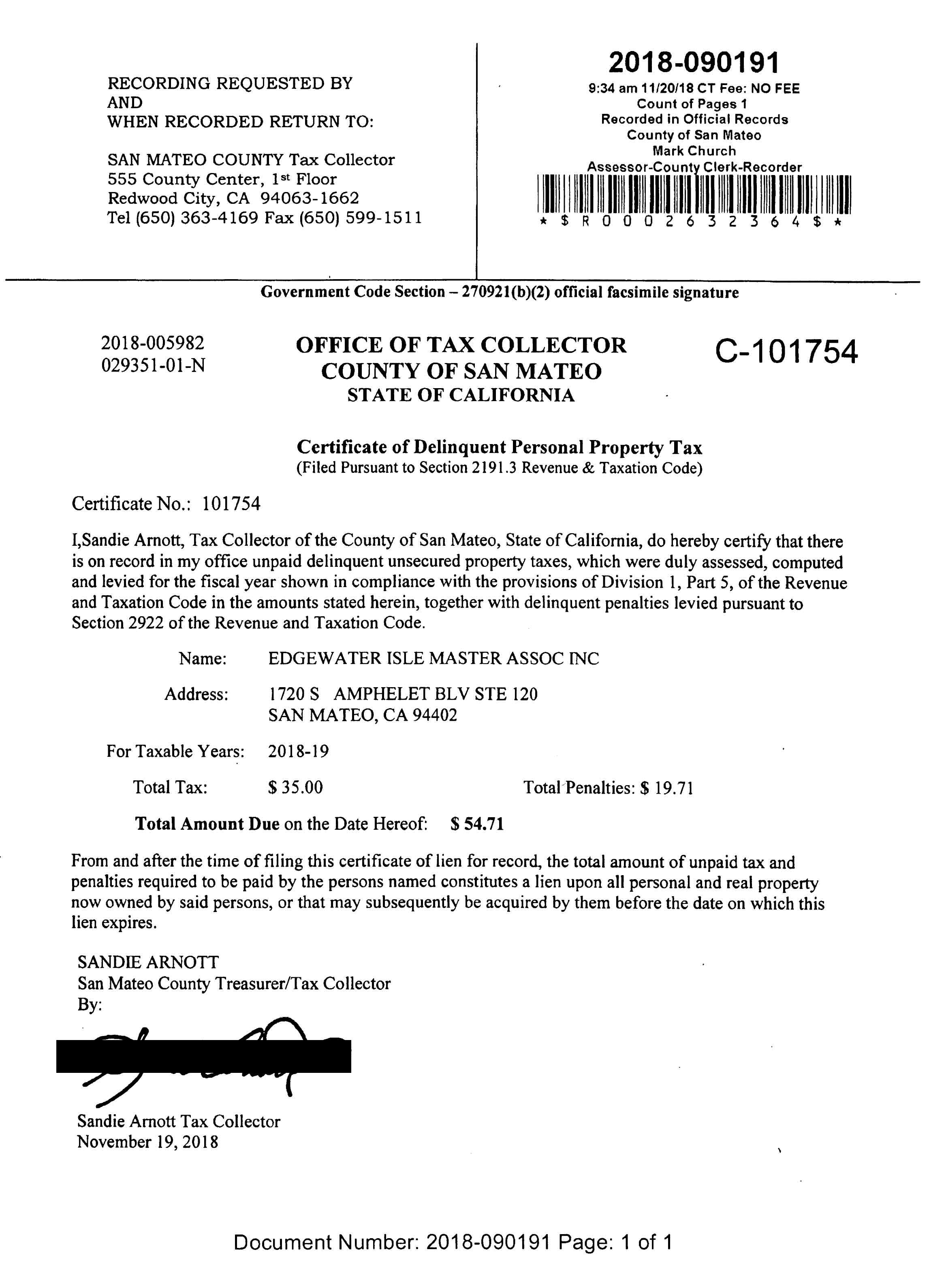

San Mateo County Issues Liens Against Master Association

111 W 3rd Ave Apt 101 San Mateo Ca 94402 Realtor Com

Gis Old Version County Of San Mateo Ca

San Mateo County Issues Liens Against Master Association

County Of San Mateo California Selects Taxsys Pittsburgh Pa Grant Street Group

California Public Records Public Records California Public

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

Charges On Property Tax Bill Montara Water Sanitary District

San Mateo County Property Values Reach Record High For 11th Year In A Row

Pay Property Taxes Online County Of San Mateo Papergov

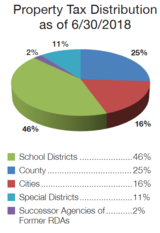

Where Do My Taxes Go County Of San Mateo Ca

Online Services San Mateo County Assessor County Clerk Recorder Elections Acre